washington state long-term care payroll tax opt out

Any employee who attests that they have comparable long-term care insurance purchased before November 1 2021 may apply to ESD for an exemption from the premium assessment. It should be repealed.

Washington House Votes To Delay Long Term Care Tax For 18 Months Northwest Public Broadcasting

1 2022 employers will begin withholding a new payroll tax from employee paychecks as a premium payment for the new long-term care benefit.

. Recent changes to Washington State law will require employees to acquire long-term care insurance by November 1 2021 to avoid additional payroll taxes. Turns out they were a bit premature. Individuals who have private long-term care insurance may opt-out.

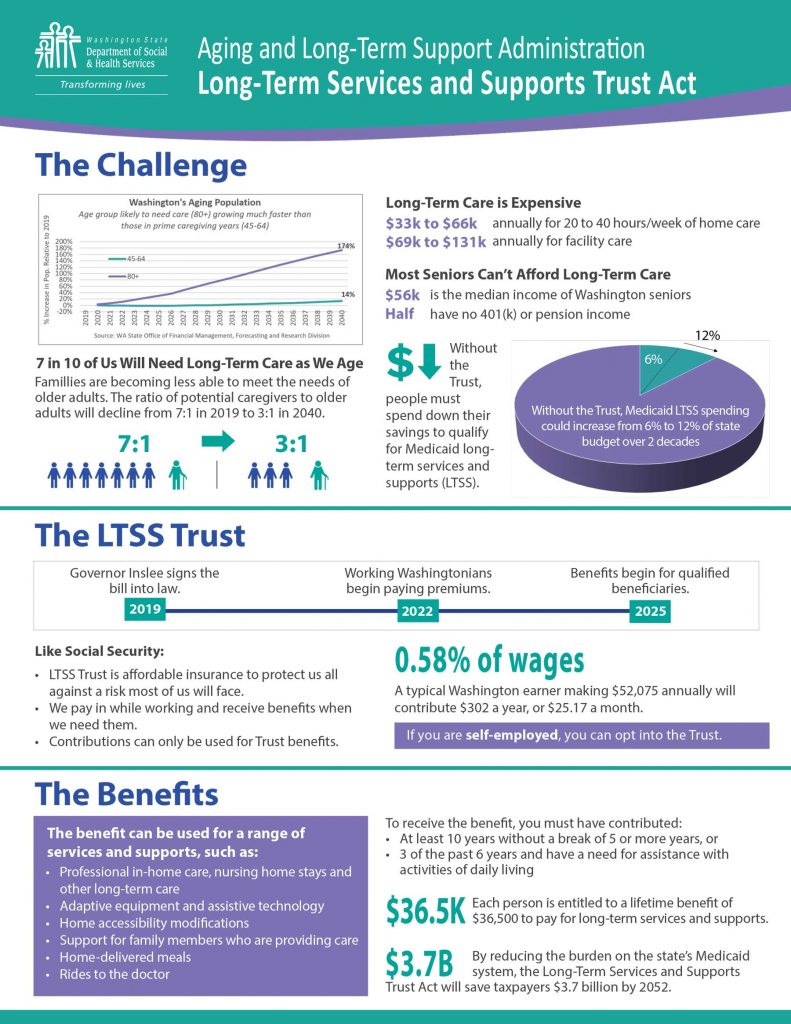

The program is funded by a payroll deduction of 058 per 100 starting January 1 2022 and will provide benefits to workers who have paid in for ten years or for those have paid. They reluctantly allowed a single opt-out choice that expires Nov. The Washington Cares Fund collects 58 cents for every 100 of income that workers in the state earn until they retire.

27 to delay the long-term care program and the corresponding collection of the payroll tax until July 2023. Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW youll click Continue to proceed to creating your WA Cares Exemption account. Opting Out of The Washington State Long-Term Care Tax After an employees application for exemption is processed and approved he or she will receive an approval letter from ESD.

The new tax is for a mandatory long-term-care program called the WA Cares Fund. November 1 2021 is the deadline to avoid the new tax by purchasing a private long term care policy. In that case the tax will be permanent and mandatory.

1 every employee will pay 58 cents for every 100 they earn. Already more than 470000 Washingtonians representing more than a third of the states payroll have requested to opt out of the program after. It is a first of its kind payroll tax of 058 of an individuals earnings and it is used to fund a long-term care.

1 2023 exemptions granted to military spouses non-immigrant visa holders and those living outside Washington will not be permanent. Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply. On the Create an Account page select the Create an Account button to the right of WA Cares Exemption.

The most significant legislative change is additional time for employees to opt out of the public program. The program which will be funded by a mandatory payroll tax will help pay for eligible long-term care-related expenses. As a further update on WA Cares Act state lawmakers passed a law Jan.

AWC partnered with other organizations and employers to successfully push back the opt-out date to November 1 2021 to allow employees more time to consider their long-term. In 2019 the legislature created the states Long-Term Services and Support Trust called Washington Cares to address a growing need for long term care supports. Beginning in July 2023 W2 workers including those with lower incomes struggling to make ends meet will be subject to a payroll tax of 58 cents for every 100 they make to fund a long-term care program called WA Cares.

Written by Brian Greenberg. One man I spoke with recently. The employee must provide this approval letter to his or her employer.

But thats what the Washington State Long-Term Care Act of 2019 would do. Starting in July 2023 W2 workers including those with lower incomes struggling to make ends meet will be subject to a payroll tax of 58 cents for every 100 they earn to fund the long-term care program under called WA Cares. A bill that moves up the deadline for employees to opt out of the states upcoming long-term services and supports program and its associated payroll taxes is on its way to the Governor.

Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline. Applying for an exemption. Employers must maintain copies of any approval letters received.

The employee must provide proof of their ESD exemption to their employer before the employer can waive. The initial premium rate 058. WA Cares Fund is a long-term care insurance tax of 058 of gross wages of workers in the state of Washington.

Read the Transcript. Can you tell us about the Washington state long-term care payroll tax. For companies that chose not to collect the tax no further action is required.

Opting back in is not an option provided in current law. Employees have until November 1 2021 to buy long term care insurance to opt out of the program and to avoid the WA LTC Payroll Tax. Hi my name is Peter Nicolas and I am the William Dwyer Chair in law at the University of Washington School of Law.

This is also true if you move to Washington state after the opt out window closes after 12312022 and you didnt already own long-term care insurance with a policy date. This alert summarizes the current state of the law resulting from final amendments adopted by the Washington State. 2 days agoBut thats what Washington states 2019 long-term care law will do.

Get a Free Quote. It should be canceled. The regressive tax is 58 cents per 100 earned with no income limit.

After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program. In 2019 Democrats in Olympia passed a hefty new payroll tax that will hit paychecks starting in January.

Can You Opt Out Of The Washington Long Term Care Trust Act

Washington State Long Term Care Tax What You Need To Know North Town Insurance

Washington House Votes To Delay Long Term Care Tax For 18 Months Northwest Public Broadcasting

The Private Ltc Insurance Option For Washington State Workers

Repealing And Replacing The Long Term Care Insurance Program And Payroll Tax Washington State House Republicans

Can You Opt Out Of The Washington Long Term Care Trust Act

Washington House Votes To Delay Long Term Care Tax For 18 Months Northwest Public Broadcasting

Wa State Long Term Care Act Updates Aug 2021 Metcalf Hodges Cpas

Washington Ltc Trust Act Opt Out Long Term Care Insurance For The Ones You Love

Washington House Votes To Delay Long Term Care Tax For 18 Months Northwest Public Broadcasting

The Private Ltc Insurance Option For Washington State Workers

New Payroll Tax In Washington State Merriman

Washington Workers Only Have Until Nov 1 To Opt Out Of A New Payroll Tax R Seattlewa

Deadline Approaching To Opt Out Of Unpopular Long Term Care Payroll Tax R Seattlewa

Washington Ltc Trust Act Opt Out Long Term Care Insurance For The Ones You Love

New Payroll Tax In Washington State Merriman

How Making Public Long Term Care Insurance Sort Of Voluntary Created A Mess In Washington State